Revenue and Net Profit Surge by Nearly 100%

FY 2025 Key Highlights

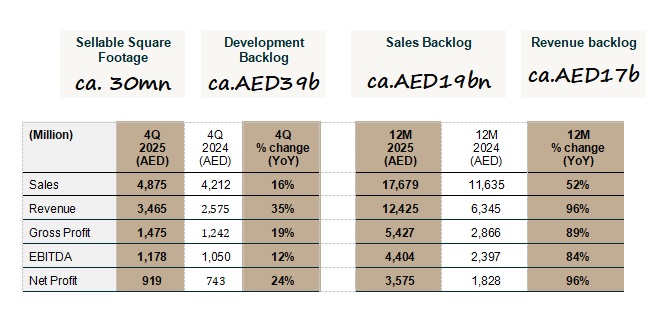

- Net profit rises 96% YoY to AED 3.58 billion

- Revenue nearly doubles YoY to AED 12.43 billion

- Gross profit up 89% to AED 5.43 billion; EBITDA up 84% to AED 4.40 billion

- Cash position increases 135% to AED 8.84 billion

- More than 17,000 units sold during FY 2025, making Binghatti Dubai’s top-selling off-plan developer by units sold

- Total assets grow 92% YoY to AED 24.37 billion

- Total equity more than doubles to AED 6.78 billion, supporting continued pipeline execution

- Binghatti’s combined portfolio of completed, ongoing and pipeline developments now stands at nearly AED 100 billion

Katralnada BinGhatti, CEO and Managing Director

“The year that just closed presents a defining period of growth for Binghatti and a clear validation of our strategy, execution discipline, and differentiated approach to development. Our record profitability and revenue performance are a direct outcome of Dubai’s strong market fundamentals and the efficiency of our vertically integrated business model, which enables us to move quickly from design to delivery while maintaining quality and cost control.

Throughout the year, we sustained strong sales momentum, accelerated project handovers, and continued to expand our development footprint across key locations and segments, reflecting both the strength of demand and the market’s confidence in Binghatti’s delivery track record.”

Shehzad Janab, CFO

“FY2025 was defined by disciplined execution and a resilient operating model that continued to perform even as the business scaled rapidly. Profitability remained strong, with a 44% gross margin, 35% EBITDA margin and 29% net margin. This performance highlights the strength of our vertically integrated model, our focus on cost efficiency and the results of a strategically balanced project portfolio.

Balance sheet strength also continued to improve meaningfully over the year. Total assets rose 92% year-on-year to AED 24.37 billion, reflecting the scale-up of our development activity and the continued expansion of our portfolio, while cash balances increased to AED 8.84 billion, providing a strong liquidity buffer and significant financial flexibility. This leaves us with ample liquidity to continue to execute our market-beating growth strategy whilst maintaining strong financial discipline.”

Dubai, UAE, 30 January 2026 – Binghatti Holding Ltd, a leading UAE real estate developer, announced record financial results for the year ended 31 December 2025, underlining strong sales execution, disciplined delivery, and continued strengthening of the Group’s balance sheet.

Net profit increased 96% year-on-year to AED 3.58 billion, reflecting robust operating leverage, efficient execution and the continued strong demand for Dubai real estate.

The company’s revenue nearly doubled year-on-year to AED 12.43 billion, compared with AED 6.34 billion in 2024, driven by strong sales momentum, accelerated project handovers and the continued success of Binghatti’s optimally diversified portfolio across mainstream, premium mainstream, luxury and ultra-luxury offerings.

In the fourth quarter of 2025, Binghatti sustained its strong momentum and closed the year with a series of landmark achievements that underscore its leadership in branded real estate, innovation, and capital markets access. The Group unveiled Mercedes-Benz Places | Binghatti City, the world’s first Mercedes-Benz branded city, further elevating Dubai’s position as a global destination for design-led, lifestyle-driven communities.

Binghatti also set a new benchmark for ultra-luxury residential demand with the sale of the Middle East’s most expensive penthouse, valued at around USD 150 million, highlighting the pricing power and international appeal of its branded portfolio.

Binghatti continued to reinforce its capital‑markets standing during the year. In its 2025 Review, GlobalCapital named Binghatti’s USD 500 million 8.125% August 2030 sukuk as CEEMEA’s Corporate Deal of the Year, highlighting the deal’s five-times oversubscription, tightened pricing and the Group’s market credibility. The issuance attracted order books of approximately USD 2.5 billion, with nearly half of allocations placed outside the GCC, underscoring broad international investor appetite.

Binghatti’s Q4 milestones build on the company’s achievements in the first nine months of the year, during which Binghatti attracted a record level of oversubscription on a private sector sukuk at 5x and launched its first single- and multi-development real estate funds via Binghatti Capital, its DIFC-based investment management arm.

Branded Luxury Milestones and Market Signalling

Binghatti achieved a record-breaking ultra‑luxury transaction with the region’s most expensive penthouse sale, valued at USD 150 million, at the Bugatti Residences by Binghatti in Business Bay. The transaction established a new peak for Business Bay at AED 11,650 per sq. ft., underscoring the premium pricing power of Binghatti’s branded developments and Dubai’s growing stature among global prime residential markets.

In addition, Binghatti and Mercedes-Benz unveiled plans for Mercedes-Benz Places | Binghatti City. As the Group’s first master community, the project builds on the success of its branded residences strategy and aligns with Binghatti’s sustainability framework through energy-efficient design, smart mobility solutions and green building practices.

Positive Market Outlook

Dubai’s real estate market continues to outperform global peers, supported by sustained population growth, rising homeownership and steady inflows of international capital. Long-term initiatives such as the Dubai Economic Agenda D33 and the Dubai 2040 Urban Master Plan continue to strengthen the city’s economic base and reinforce housing demand.

Against this backdrop, Binghatti’s vertically integrated structure, disciplined project management and differentiated branded strategy position the Group to sustain its growth trajectory into 2026 and beyond.

– ENDS –

About Binghatti Holding Limited:

Binghatti Holding Limited is a vertically integrated real estate developer founded in 2008 with roots as a contractor before transitioning into full-scale development. Leveraging in-house design, development, construction and delivery capabilities, the Group stands out as one of Dubai’s most avant-garde private developers, operating across the full market spectrum from affordable housing to ultra luxury branded residences.

With a total portfolio exceeding 90 projects valued at nearly AED 100 billion, Binghatti has delivered more than 50 projects to date and maintains a robust pipeline of approximately 30 million square footage of sellable area.

Binghatti delivers across the housing ladder from affordable and mid-market homes to premium and ultra luxury branded residences differentiating itself through design led products, branded collaborations and a consistent focus on customer outcomes. The developer’s contractor heritage underpins its operational agility and ability to scale across segments.

Sustainability is embedded across Binghatti’s developments through energy efficient technologies, responsible materials selection and long-term value creation strategies that enhance returns for stakeholders and liveability for residents.

Founded on contractor roots and built around a vertically integrated model, Binghatti Holding continues to expand its real estate portfolio to meet growing market demand, delivering quality projects across every market tier while prioritising design, delivery excellence and sustainable outcomes.

Further Information for Media and Investors

For media enquiries, please contact:

Mahmoud Kassem

Brunswick

mkassem@brunswickgroup.com

+971 56 177 0899